The First Bank recently donated $50,000 to the Biloxi Public School District to support the Biloxi Early Learning Collaborative, a prekindergarten program for students four years of age. The donation will benefit the development and improvement of their pre-K program, which is partially funded by the state of Mississippi and reliant upon donations to achieve full funding.

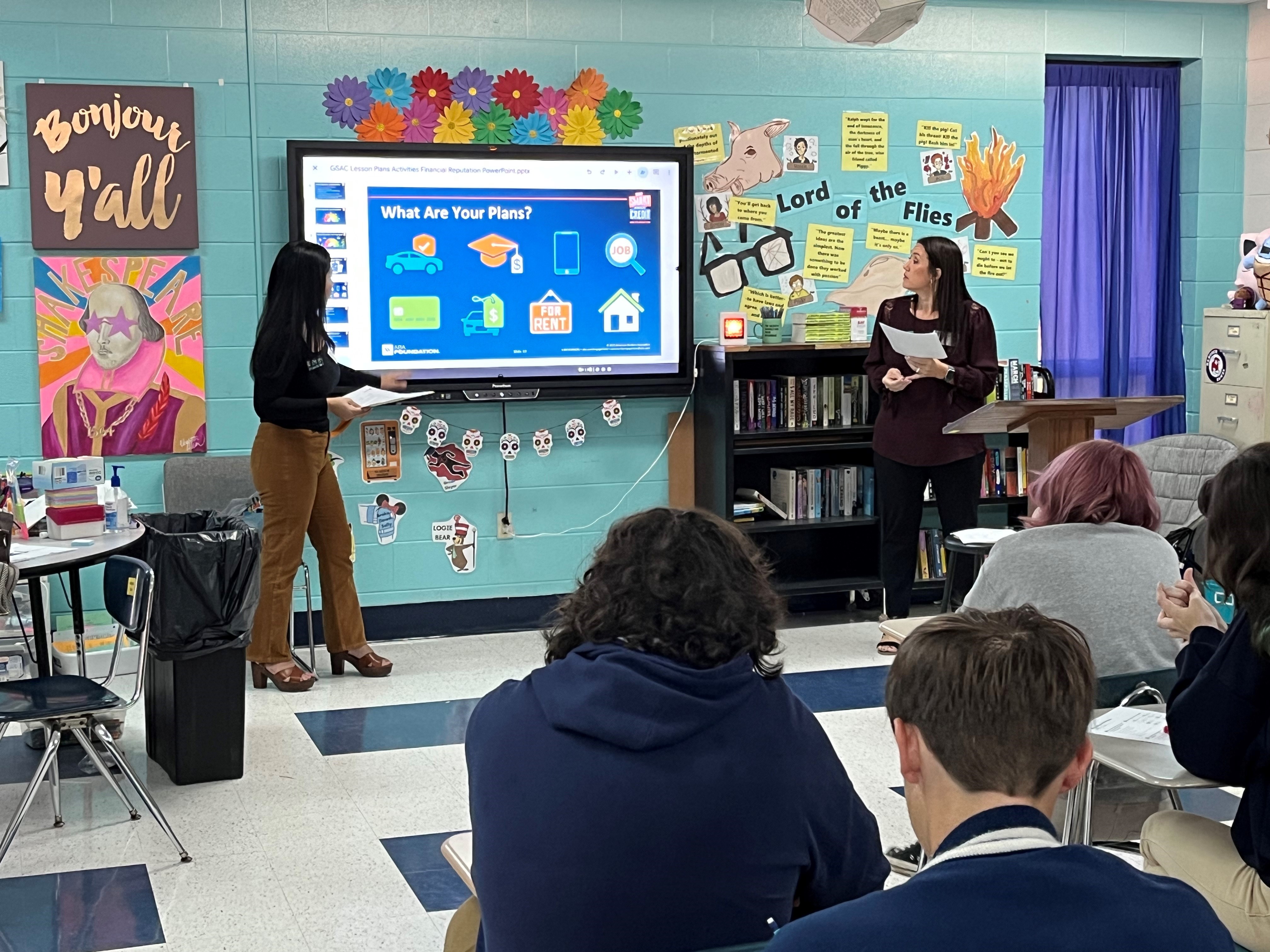

THE FIRST BANK JOINS NATIONAL STUDENT FINANCIAL EDUCATION CAMPAIGN

The First Bank has joined the American Bankers Association Foundation and banks across the country in promoting the Get Smart About Credit program, a national campaign that encourages banks to teach teens and young adults how to manage their money. In recognition of the program’s awareness day celebrated on October 19, the bank shared tips on using credit wisely, saving for the unexpected, and careers in banking through presentations in local schools near its branches and on the bank’s social media channels throughout the month of October.

Sorry, there are no articles in that category. Please try your search again.

MAKING INFORMED FINANCIAL DECISIONS ABOUT PAYING FOR COLLEGE

Many factors and decisions go into choosing and paying for college. In-state versus out-of-state? Public or private? Can I afford the school of my dreams? Is it wise to take on so much debt? While individuals' requirements and answers differ, one thing is constant. The cost of college is considerable and rising.

Completing a college education is frequently a family commitment and the price tag often represents the second largest investment that a family makes, next to buying a home. Prepare for this investment in your future by using skills developed throughout your academic career. Research and get the facts.

SPOT A PHISHING SCAM FROM A MILE AWAY

Every day, thousands of people fall victim to fraudulent emails, texts and calls from scammers pretending to be their bank. And, in this time of expanded use of online and mobile banking, the problem is only growing worse. In fact, the Federal Trade Commission’s report on fraud estimates that American consumers lost a staggering $10 billion to phishing scams and other fraud in 2023 — an increase of 13.6% over 2022.

It’s time to put scammers in their place.

PUT FRAUD IN ITS PLACE BY PRACTICING SAFE CHECKS

RENASANT CORPORATION TO ACQUIRE THE FIRST BANCSHARES, INC.

THE FIRST BANK PARTICIPATES IN AMERICA SAVES WEEK DURING APRIL 8-12

The First Bank is a proud participant in America Saves Week, an annual national campaign that encourages and empowers individuals, families, employers and communities to evaluate their finances. The campaign focuses on several important topics that comprise the personal financial landscape with a realistic economic approach including saving for emergencies and unexpected expenses, leveraging automatic savings, retirement and reducing debt, as well as topics like talking to your family about money, understanding your employer's financial well-being benefits, and the mental and emotional effects of financial stress.

.jpg)

SAVING AT ANY AGE

Saving. Do you view it as an ongoing journey? Or do you consider saving as someplace you arrive at? At The First, we are in the camp that saving is a habit, not a destination. And it’s a habit that can be formed at any age. Whether you are a parent trying to instill this habit in your children or you want to change your own saving behaviors, there are strategies that savers of all ages can develop.

.jpg)

SAVING FOR THE UNEXPECTED

How often have you heard that saving for life’s unexpected events is very important and a necessary part of being financially prepared? Most likely plenty of times! Accompanying this message often is the statement that you need three to six months of expenses in your emergency savings account. Instead of focusing on what you haven’t accomplished, here are a few strategies to consider that may help you build your financial confidence and begin or continue on your path to saving for the unexpected.

.jpg)

TIPS TO INCREASE YOUR CREDIT SCORE

It’s safe to say that most of us understand the importance of credit in today’s world. Not only does it affect your buying power, but it can also affect your ability to rent or own a home, get a job, and even what you’ll pay for insurance coverage. Trying to maintain a healthy credit score can cause some individuals anxiety, stress, and even depression. It’s important to gain a clear view of where you are financially so that you can set a goal and make a practical plan of where you want to be in the future.

.jpg)

SAVING FOR COMPETING PRIORITIES

Saving for everything that is important to you can seem overwhelming at times – there are so many things you may want to achieve financially and many of us find ourselves wondering which ones we should focus on first.

It’s important to have a plan in place for handling these competing priorities in order to balance them and work to achieve them all without getting overwhelmed and frustrated.

.jpg)

STAYING ON TRACK WITH YOUR SPENDING AND SAVINGS PLAN

Life happens (no matter what plans you may have) and can set our finances off in a tailspin if we let it. Even with the most thought-out plan, things can get in the way and cause us to fall off track with our finances from time to time.

Fortunately, there are things you can do to stay on course and keep your finances in line – even when life has thrown you a curveball - or two!

.jpg)

SAVING FOR LIFE'S MAJOR MILESTONES

When you’re young and just starting out, it’s important to consider and plan for all of life’s major milestones that are on your horizon.

Here are a few goals to consider now that will help you get your financial life in order and ready for all the important events and milestones, you’ll encounter on this journey called life……

.jpg)

SAVING AUTOMATICALLY

Does it seem that everyone around you knows the secret to saving successfully except you? It’s not unusual to feel unconfident about saving, no matter how much money you earn. Confidence doesn’t necessarily come with having a lot of money. Rather it comes from building healthy financial habits and using the resources you know are available to you – this is your financial confidence!

.jpg)

TALKING ABOUT FINANCES AS A FAMILY

Money is a sensitive subject and talking about it, even with those closest to you, can almost seem taboo at times. However, it’s important to discuss money management and financial goals as a family. And these conversations about money aren’t just limited to your spouse and children. It’s important to also discuss finances with your parents and other important loved ones as well.

THE FIRST BANK DONATES $1 MILLION TO HISTORICALLY BLACK COLLEGES AND UNIVERSITIES

The First Bank recently donated $1 million to 12 historically Black colleges and universities across Mississippi, Louisiana, Alabama, Georgia and Florida. Recipients in each state include Jackson State University, Tougaloo College, Southern University and A&M College, Southern University at New Orleans, Dillard University, Xavier University of Louisiana, Bishop State Community College, Albany State University, Savannah State University, Clayton State University, Florida A&M University and Edward Waters University.

THE FIRST BANK JOINS GIVINGTUESDAY GLOBAL CHARITABLE MOVEMENT

The First Bank has joined the global charitable movement, GivingTuesday, with a $25,000 donation to The Salvation Army, which benefited its centers throughout Alabama, Florida, Georgia, Louisiana and Mississippi. In support of the non-profit’s dedication to “doing the most good,” The First has donated over $51,000 since 2008 to The Salvation Army to support their efforts to overcome poverty, addiction and economic hardships through a range of social services including food, disaster relief, rehabilitation services, clothing and shelter.

THE FIRST BANK DONATES $20,000 TO SUNNYBROOK CHILDREN’S HOME

The First Bank recently donated $20,000 to Sunnybrook Children’s Home in Ridgeland, Mississippi to help provide housing for foster children within the state. Celebrating its 60th anniversary this year, Sunnybrook provides safe and nurturing homes for foster children who have or will soon age out of the foster care system. Through programming, staffing and facilities, the children’s home ministers to transitional-age youth with a goal of providing the tools they need to succeed and thrive as engaged members of their communities.

%20(1).jpg)